(This is an executive Summary written by Guillaume Jourdan. For more recommendations, VitaBella Luxury Wine clients can read our new report “A roadmap for wine brands to build effective digital strategy in 2015”. Follow us on Facebook)

In the luxury industry, strategy is key. THE GUARDIAN recently gave a clear example in this sector and explained why the Mulberry brand has failed: “Increasing its price point put the brand out of reach and alienated its core consumer. Inflating the product price could only serve to undermine brand value in the eyes of the consumer.Part of the problem was that savvy consumers did not see the value in paying inflated prices for bags that would have cost them much less a few years ago. Mulberry didn’t have the brand equity to justify the increases and consumers started opting for better established luxury labels as a safer investment.” Nothing to be added apart from the fact that you could change the Mulberry brandname by the names of some ultra expensive wines (including some Bordeaux grands crus) and the statement would still work.

To be fair, in this struggling economy, even luxury brands which followed the right strategy are experiencing tough times. Every major luxury goods maker has been hit by the worst spending slump in five years with concerns about economic growth and conflicts. And China, growing at its slowest rate since 2009, is today the major concern whereas the U.S. is proving a growth engine. LVMH said China was its weakest market globally in the third quarter, adding that its sales of wine and spirits were sluggish in the country. Kering SA, parent of Gucci, sees a similar trend. Gucci sales in mainland China fell in the third quarter. Sounds familiar when we are talking about Bordeaux grands crus, isn’i it?

What is happening in China? First, many wealthy Chinese customers have become more sophisticated and moved on to smaller, niche brands. Second, the Chinese have cut gift-giving and reined in their personal spending. Finally, the big brands are not capturing aspirational consumers, because these people are turning to brands at lower price points. And the growth trend in China’s luxury goods consumption will be difficult to maintain this year, according to a survey by top US management consulting firm Bain & Company.

Since 2009 China has given a boost to the luxury sector. But what about the future? What about 2015 and beyond? “Digital could be “the next China” for the luxury industry”, Exane BNP Paribas analyst Luca Solca forecasts. Selling online would be the next growth opportunity? Today about 40% of high-end brands – including Chanel – don’t sell via the Web, estimates consultant Bain. On which side should a luxury wine brand stand? In fact,the digital torrent is coming faster than we thought. Information Technology has to adopt new capabilities to keep pace with the flow of data and communication. Information Technology needs to articulate the impact of web and mobile app performance by using common metrics that help the brands engage customers. With digital come new metrics for luxury wine brands: customer adoption, engagement and satisfaction.

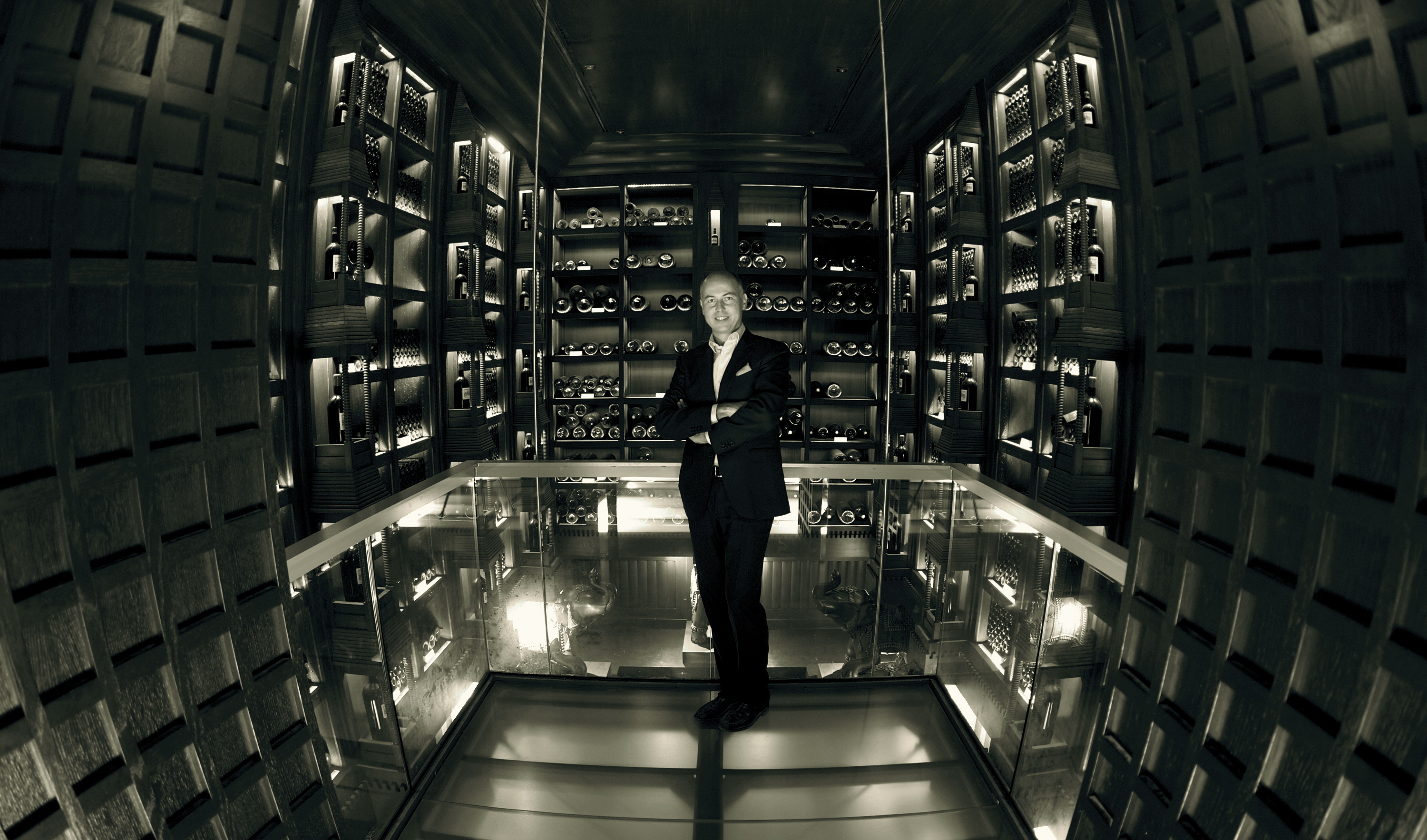

Right now, wine brands must get prepared to the future including selling online. Before, it was enough to distribute through brick and mortar stores and restaurants to sell. Now wine brands need to go digital to show innovation which affects brand desirability and, at the same time, need to build the aura of exclusivity. The most poweful wine brands will aim to design multifunctional, controlled spaces that create brand experiences and communicate brand beliefs. It’s all the more challenging for wine brands since it is impacting various operational levels at the wine estate.

Let’s consider an example among one of the few aspects that a digital strategy should consider: Social Media. The latest Forrester report “Social Relationship Strategies That Work” notes that top brands’ Facebook and Twitter posts only reach around 2% of their fans and followers, and less than 0.1% of fans and followers actually interact with each post on average. The latest updates to Facebook’s news feed algorithm will soon make it even less likely that brands’ unpaid posts will actually be seen by users. Guess what would Forrester recommend for the future? 1) Add social relationship tools to your own site 2) Stop making Facebook the center of your relationship marketing efforts.

Could Digital be “the next China” for Luxury Wines ? It could be. But make sure you define the right strategy and implement it correctly. For more recommendations, VitaBella Luxury Wine clients can read our new report “A roadmap for wine brands to build effective digital strategy in 2015”.

(*Since 2003, Guillaume Jourdan has been advising more than 200 prestigious wine estates for their international Marketing & Communication strategy incl. Chapoutier, Hugel, Dr Loosen, Famille Perrin, Cos d’Estournel, Brad Pitt & Angelina Jolie’s Miraval…Write to Guillaume info@vitabella.fr)